Planning is overrated. I can plan as well as anyone—a trip, an event, a course—but the opportunities for which I plan (the travel destination, the conference to host, the subjects to teach) are usually beyond my control and a matter of chance. Certainly the greatest events in my life (marriage, jobs, spiritual conversions) are responses to unforeseen opportunities, not results of planning for specific objectives.

The same is true in my writing. My first scholarly publication (on obscure points in medieval logic) grew out of notes to a graduate school friend in theology. My second (on agrarianism and Catholic social teaching) was elicited after comments in a seminar. A recent foray into non-academic spiritual writing (a co-authored book about the interior life) was invited by a friend, based on conversations over years. A writer’s career is not engineered.

My most-read publication is probably a review essay about five books, the “Incerto” series, by Nassim Nicholas Taleb, also unplanned. I kept coming across Taleb’s name, decided to start reading, and shared some reactions on Twitter—prompting an invitation from an editor. It was fun to write, and I’m proud of it, but I have published other pieces with more intentionality, and I have on my hard drive, going back 20-plus years, things more diligently planned which will never be finished.

In terms Taleb would use, what I’m describing is “optionality.” Rather than deciding on a single thing to do (at which I might succeed or, more likely, fail), my strategy as a scholar and writer has been to position myself to respond to unpredictable opportunities. Over time, some actions “pay off,” but I “risk” very little on the various individual efforts that expose me to those opportunities. Success isn’t predicting and planning winning actions, but avoiding costly losses while increasing the chances that something you do (you don’t know ahead of time what) might succeed. A typical “research program” might focus on a specific goal, but this makes you “concave” (with a downside if things don’t go as planned); it turns out my intellectual habits have made me “convex” (safe in normal situations, but open to significant benefit if unexpected things happen at the margins).

And so it seemed especially fitting that serendipity led me to Taleb’s Real World Risk Institute in New York City last month. The timing of a sabbatical gave me more-than-usual flexibility during the semester, lecture invitations in other cities (including one on agrarianism and subsidiarity) were easy to coordinate with the timing of RWRI, and my essay on Taleb smoothed the way. (Full-price tuition is steep, but RWRI offers some scholarships.) A complete session is five days, all day Monday through Friday. I attended the less technical first two days.

As an academic, I was in the minority among 65 participants; most are active “in the real world”: entrepreneurs and fund managers; programmers and data scientists; specialists in insurance and real estate; an urban planner and a psychological counselor. And they came from all over the world – I had conversations with people from Spain, France, Lebanon, Russia, and Norway, and across the US. Taleb was the main instructor, joined by Raphael Douady (mathematician and economist), Robert Frey (mathematician and trader, Twitter @financequant), Joe Norman (complexity scientist and homesteader, @normonics), and Pasquale Cirillo (financial mathematics, @DrCirillo), who have all collaborated with Taleb in some way.

What brings all these people together is the logic of “risk” and the understanding that, the better it is understood, the better we can make decisions. While my intellectual formation translates this into the classical virtue of prudence, the common language at RWRI is mathematics, and one of the delights of the conference was watching Taleb play around with a powerful software (Mathematica) to calculate probabilities and generate graphs. The preliminary and recurring insight is that statistics is not about finding patterns, but about discerning which things that look like patterns aren’t (the title insight of Taleb’s first book Fooled by Randomness). The goal isn’t to accumulate data but to filter out noise. (That’s also, by the way, the trick to surviving Twitter.)

Typical statistics textbooks teach standard (Gaussian) distribution – “the bell curve” – in which things like means and standard deviations most matter. Some domains (like the sums of thrown die) naturally cluster around an average between strictly constrained extremes. If you know that the total height of two randomly selected people is 12-and-a-half feet, chances are the two people are each very close to 6 feet, 3 inches.

But if you know the total wealth of two randomly selected people is $125 million, the chance that wealth is close to evenly distributed is quite small; there is a very high chance that one of them has total wealth of close to $125m. Unlike the size of an organism, the size of a bank account does not have a natural limit, and wealth isn’t evenly distributed around a mean. It takes wisdom to know when we are in Extremistan rather than Mediocristan, so that we are not harmed by, and can even benefit from, a rare and unforeseen outlier (“the black swan,” the title insight of Taleb’s second book).

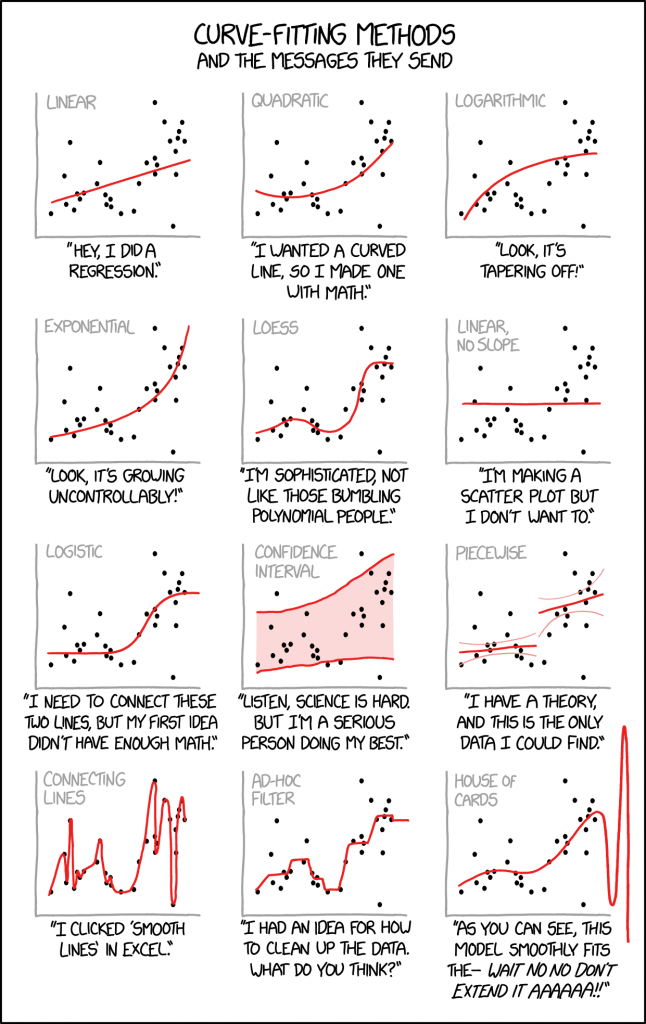

This means that many of the analytic tools of social science—like correlation and linear regression—are much more limited than usually acknowledged, and often deceptive: one can always “fit” a line to random data and find spurious “correlations” in large enough data sets. (Taleb has shown that, given enough towns, high incidents of cancer in some towns would be expected from random distribution; “cancer clusters” are not sufficient evidence of a nefarious “cause.”)

But more important than the consequences for scientific analysis are the consequences for practical reasoning. For Aquinas the first specification of the natural law is to preserve oneself in being, and for Warren Buffet the primary investing rule is “first survive.” Even if five out of six doctors certify Russian Roulette as safe—and even if we add enough incentive to yield an attractive “cost benefit analysis”—we know better than to play even once.

No doubt many attendees hoped for specific investing advice, and it’s not proprietary: the Kelly Criterion is more convex than dollar-cost averaging (the default for those with 401k-style regular investments), and wherever possible “clip the left tail” (limit downside) while maximizing possible upside (a diverse portfolio of options where most might lose but only a little, while you have a chance of eventually winning big; or less, honorably, by investing borrowed money in real estate where default can limit any losses.)

But prudence applies to more than growing your bank account, and the excitement of RWRI seems to be around its application to other phenomena in everyday life. The dominant modern metaphor of the machine invites us to expect things to be static, constrained by a “blueprint,” predictable, reducible to parts, and easy to manage. But in the real world, systems – organisms, ecosystems, cities and markets, families and projects – are dynamic and complex, resist reductive analysis, and remain always somewhat mysterious.

Indeed, the sign of health in any living system is its ability to survive, and even strengthen, under stress. The whole seems to have an intrinsic but elusive logic that communicates order—including growth and healing—to the parts. Organisms and organic systems are (within a certain range at least) the opposite of fragile—they don’t simply endure but are made stronger in response to stress (“antifragile,” the title of Taleb’s fourth book).

Consider all the different manifestations of pressure on a system, which Taleb calls the “disorder brothers”: uncertainty, variability, imperfect knowledge, chance, chaos, volatility, disorder, entropy, time, the unknown, randomness, turmoil, stressors, error. If something doesn’t “like” any one of these, it’s not going to like the others (and will therefore be short-lived before failure). On the other hand, if something is made stronger by these, it is antifragile—and therefore also displays the “Lindy” effect (the longer it lasts, the longer it is expected to continue lasting).

The insights are useful to check the ambitions of modern power. Should we trust a model that recommends engineering drastic change in the atmosphere, or should we defer to and protect the Earth’s proven, inscrutable systems of climactic balance? Should we tinker with DNA to design a new kind of pest-resistant crop, or should we respect the nucleic wisdom encoded in long-proven varieties? Risk management’s “precautionary principle” can be understood as respecting essential systems that are Lindy and making sure one doesn’t interfere with whatever makes them antifragile: solve world hunger with better distribution logistics (low downside, huge upside), not by playing God with crop genes (huge possible downside).

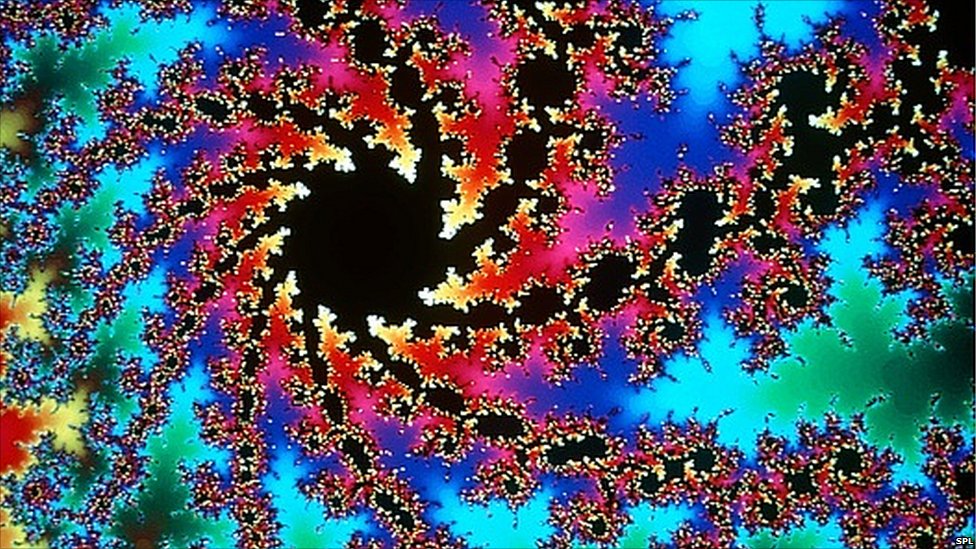

In social life, this suggests a bias in favor of traditionalism (including respect for religion) as well as encouragement for experimenters and entrepreneurs (tinkerers, who actually try new technology, not scientists and economic “experts” who merely theorize). In political organization, it shows the wisdom of localism—or what Taleb calls “fractal localism,” to distinguish it from simplistic decentralization. (A “fractal” exhibits structure reproduced multiple times at different scales. Benoit Mandelbrot, a hero of Taleb’s, coined the term after noticing in the 1960’s that the “randomness” of financial market fluctuations exhibited non-Gaussian and scale-invariant structure.) Political community is healthiest when people making decisions also have the most at stake in their outcomes (“skin in the game,” the title of Taleb’s fifth book). In aesthetics too, we can appreciate that much of what makes for timeless beauty and usefulness involves iterated complexity at multiple scales: in a forest as in a cathedral, what is fractal is both functional and lovely.

The key ideas I saw covered in two days can all be learned from Taleb’s books, but there was real value in seeing particular applications, discerning new connections, and witnessing entertaining arguments between instructors. The insight of fractal design informs the institute’s format, which seems to have evolved naturally and which thrives on friction and feedback. While every participant received a thick binder full of prepared power-point slides, the presentations bounced around and were not held to a script; as much was conveyed by the unplanned disagreements and clarifications as by any planned remarks. (The format also engages different types of interest and elicits diverse retrospective summaries; compare mine to these by two fellow participants, a personal reflection and a collection of takeaways. Fair warning: RWRI aphorisms tend to be formulated with… conspicuous thumos.)

Many in the room were repeat participants, and among veterans there is a clearly a culture of friendship and sense of privileged membership. The curiosity and intellectual diversity is astonishing. Taleb seems to provide a mode of thinking and speaking about life that is not limited by or infected with conventional academic categories. It should be more common in universities, but it’s not, for people of different training and temperament to argue in front of their students, and for a single conversation to move effortlessly between the rationality of an investment strategy, the beauty of a medieval street, the idiocy of the United Nations, the hubris of bankers, the insight of religious texts, the truth of a mathematical theorem, and the unity of the virtues.

Perhaps I should not have been surprised, then, but I did not expect such keen interest in spiritual matters. Over meals, various participants led me into conversations about angels, afterlife, God, contemplation, sin and redemption, prayer, and the nature of Christian faith. (I missed Thursday’s presentation by computer scientist Trishank Karthik Kuppusamy, @trishankkarthik, but we had a fantastic discussion about the metaphysics of mind over dinner on Monday.) The depth of curiosity and wonder was invigorating. Something about Taleb’s emphasis on practical wisdom unleashes in his readers a sense of humility, a renewed trust in reason, and a spiritual hunger courageous enough to move beyond the cynicism and skepticism typically bred in schools.

In high school in the late 1980’s, I wrote a paper on fractals in biology, or, as I pretentiously called it, “non-linear dynamics in physiological systems.” This too was a product of serendipity (my mother, a math teacher, was aware of then-nascent chaos theory) mixed with another ingredient in optionality, strategic laziness: I wanted a single paper topic that would fulfill the requirements for both physics and biology. Did that work plant the seeds for an appreciation of what is Lindy and antifragile in the intellectual life too? Did it prepare me to be receptive later to classical philosophy and the Catholic faith? Maybe, but I couldn’t have predicted all that at the time. Likewise, although I don’t know how, I trust my time at RWRI will bear fruit. At least, I had a blast, and it can’t hurt.

Taleb’s recent work is basically “smaller is better, but with math” (and as always, he really needs an editor, but his ego clearly won’t allow it). Which is fine, I suppose, since there are those who will nod their heads at that, who don’t think there’s enough wisdom in ancient (or just old?) sayings like “don’t put all your eggs in one basket”, “look before you leap”, etc. Unlike our current reigning principle of “let’s put highly educated people in charge of everything, they know best”, those insights have stood the test of time because they actually have applicability to this universe…

Thanks for your comment. I think Taleb would be just fine with your description of what he’s recommending — mostly unlearning bad theories of modern experts to make room for classical insight and common sense. But unlearning is hard. (And you know he’s been blunt about the role of editors, right? He does have sales numbers on his side….)

Well, Taleb is often right but never in doubt. He definitely needs an editor. But yes, he is successful enough to tell any editor or publisher to pound sand if they won’t let him have his way.

I think porchers would LOVE Joe Norman. His twitter feed is great (and shows why he must get along great with NNT), I wish he wrote more/longer pieces.

Thank you for sharing, and best of luck to you.

This comment is ironic, it shows you don’t understand what he’s written. Why does he need an editor? He sold a massive amount of books, what more evidence do you need that his approach worked. This is exactly what he means when he talks about theory vs practice.

Let me prove to you with my response that I do in fact understand NNT:

You’re an idiot. I’ll say what I like about his writing, and if you don’t like it, you can take a hike (and I’m censoring myself there, of course, since this is a family-friendly site), fhmt?

Thanks for the article, Professor Hochschild. I came across James Gleick’s book on chaos theory around the same time as you. An Army buddy turned me on to it. It never occurred to me that it (as well as Taleb’s work) could be a gateway to medieval metaphysical thinking. I’ll have to check that aspect of it out.

By the way, it’s rather apt that Taleb’s name means student in Arabic.

Comments are closed.